Who cares about Guaranteed Value™?

When it comes to insurance, a primary concern of classic and collector car owners is how much their policy will pay out if they are involved in an accident and their car is a total loss.

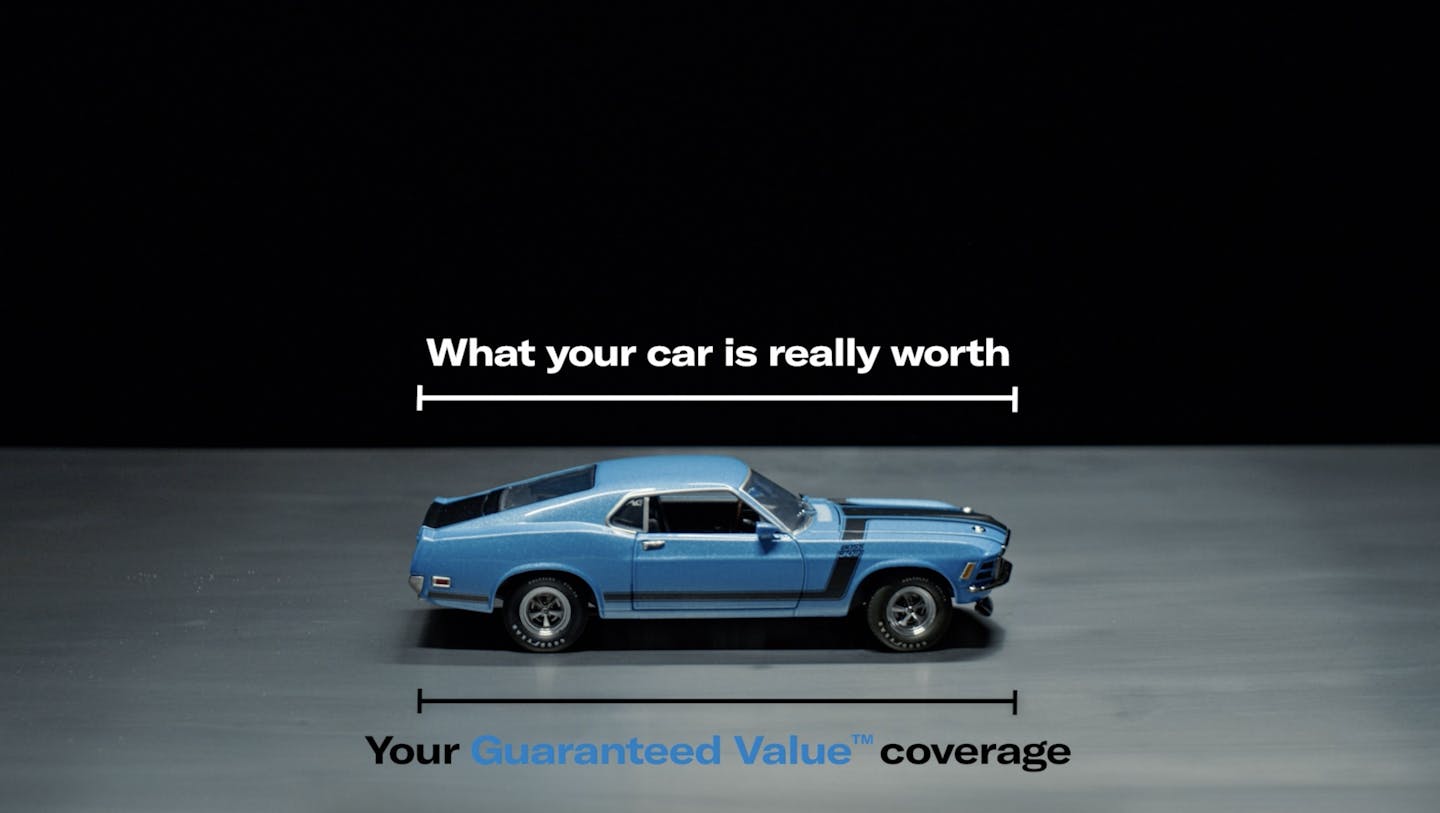

A big factor of the insured's payout in the case of a covered loss depends on what type of coverage they have on their vehicle. We’ll dive into two types of coverage in this article, Stated Value and Guaranteed Value™ (also known as Agreed Value), but first, we must review something called Actual Cash Value (ACV).

What’s the difference between specialty and everyday insurance?

Specialty and everyday insurance policies differ greatly when it comes to vehicle value and how clients are compensated in the event of a loss. There are three ways auto insurance can pay out claims:

- Actual Cash Value: Most general auto insurers offer Actual Cash Value policies. This is what an insurance adjuster says the car is worth, usually based on used car values and not the collector car market. If your client's vehicle is stolen or declared a total loss after an accident, it’s unlikely the client will be compensated for its true value.

- Stated Value: Many general auto insurers offer a Stated Value policy option for collector vehicles, which allows insurers to pay the lesser between Stated Value and Actual Cash Value and is based on the used car market rather than the collector car market. What’s more, it does not cover 100% of the vehicle’s value. In fact, it may pay less than the Stated Value if the Actual Cash Value is lower at the time of the accident.

- Guaranteed Value (Agreed Value by Hagerty): Most specialty insurers offer an Agreed Value policy. Hagerty offers Guaranteed Value. You and your client help determine an accurate value up front and that’s what they’re paid if there’s a covered total loss.* Guaranteed Value ensures they’ll be compensated for the true cost to repair or replace their collector vehicle based on data from Hagerty Valuation Tools®, not the used car market.*

What is a collector vehicle?

Different companies have different vehicle and age requirements, but vehicles are generally considered “collector” if they are not daily drivers, they maintain or appreciate in value, and are of limited production or special interest.

What kinds of cars does Hagerty protect?

- Classic and antique cars

- Modern classic and collectible automobiles from 1990 to today (think two-door sports cars and convertibles, up to the current year)*

- Collectible Exotics – Ferraris, Lamborghinis, Maseratis, and more

- Collectible trucks, Jeeps, vans, and SUVs that are from 1998 or older can be considered

- Modified vehicles like hot rods, replicas, off-track collectible race cars, pro-street and custom imports*

- Retired military vehicles, commercial vehicles, and tractors, such as semis, Jeeps, tanks, and fire trucks

*Eligibility rules and coverage availability may vary by province.

What should you look for when recommending specialty/enthusiast coverage to your client?

One of the biggest misconceptions among buyers is that the right auto insurance coverage is always the least expensive. But you know as well as we do... The best policy for your customer isn’t always the cheapest. And that’s especially true for collector and enthusiast vehicles.

- Guaranteed Value coverage: It’s the only way to make sure clients protect the full value of their collector vehicle.

- A good reputation: Ask other brokers and those in your network that are interested in collector vehicles who they use and why. Find out how companies treat their clients and deal with claims, including repair shop of choice or paying insureds to do the work themselves.

- The freedom to drive: Check to make sure your clients have flexibility when it comes to driving their vehicle, both how often and where. For example, some companies limit coverage to car shows only or don’t cover a loss if the vehicle is in a grocery parking lot.

- An authentic love for cars: As a passion asset, your clients will appreciate an insurance organization that has experience, expertise, and passion when it comes to collector vehicles.

As a trusted advisor to your client, you have the opportunity to not only protect your clients' prized possessions, but also connect them to a global community of like-minded car enthusiasts through Hagerty Drivers Club®.

Get more broker insights from Hagerty to grow your business through the collector car market.

*In the event of a covered total loss, Guaranteed Value coverage ensures your client receives every cent of their car’s insured value, less any deductibles and/or salvage value if retained (BC, MB & SK: and after settlement with government policy). AB & QC: Agreed value applies under the Guaranteed Value Plus Endorsement.

Membership benefits by Hagerty Drivers Club (HDC), a non-insurance subsidiary of The Hagerty Group, LLC. Purchase of insurance not required for membership in HDC. Policies are underwritten by Elite Insurance Company. Some coverage not available in all provinces. This is a general description of coverage. All coverage subject to policy provisions, exclusions, and endorsements. Hagerty determines final risk acceptance.

Hagerty, Guaranteed Value, Hagerty Drivers Club & Hagerty Valuation Tools are registered trademarks of The Hagerty Group LLC, ©2026 The Hagerty Group, LLC. All Rights Reserved. The Hagerty Group, LLC is a subsidiary of Hagerty, Inc.